We are here to help you through the paperwork process. If at any point you need assistance please feel free to email our Service Center or contact your advisor directly.

Schwab Alliance provides a secure, easy way to get on-demand access to important account information and documents and manage your account details.

* You must be listed as the account owner to enroll in electronic delivery. You may also be eligible for lower electronic equity trade commissions if you enroll in electronic delivery.

To help you get up to speed with Schwab Alliance, we are providing a series of videos that show how to perform some of the most common tasks. Click on the questions below to view the links.

For on-the-go access to your account, use the Schwab Mobile app to view balances and positions, make deposits, and more. Visit the app store designed for your mobile device and search for Schwab Mobile. Use your new Schwab Alliance credentials to log in once your account has transitioned to Schwab.

A trusted contact is a person or persons you authorize Schwab to contact on your behalf if account activity raises concerns such as potential financial exploitation, or if we have problems reaching you or communicating with you about your account.

Your trusted contact can confirm current contact information, health status, or contact information for other authorized parties associated with the account.

Your trusted contact is not authorized to act on your behalf, make transactions, or take other actions on your account.

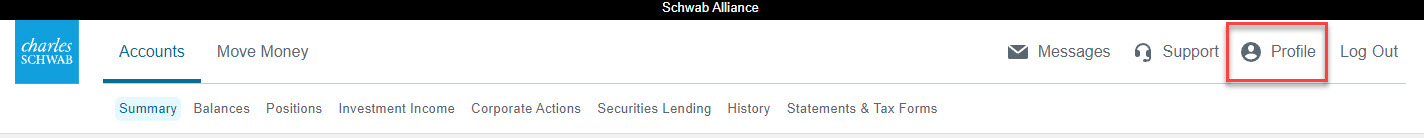

STEP 1: Login to your Schwab Account by visiting client.schwab.com.

STEP 2: From the top right hand menu click on “Profile”

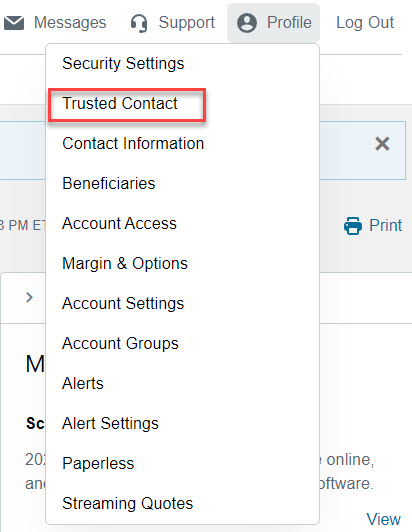

STEP 3: From the drop down menu, click on “Trusted Contact”

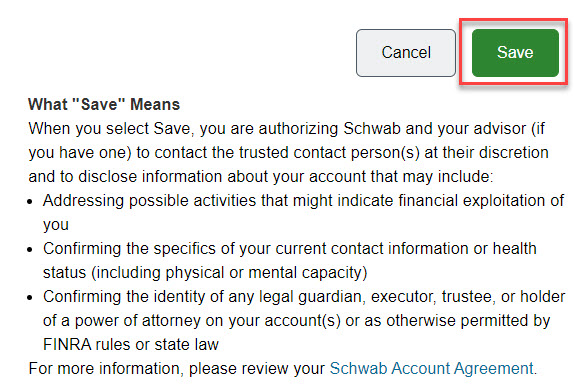

STEP 4: Once you have completed the contact information, click on “Save”

To ADD: To add a new contact click on the green button “Add Trusted Contact”

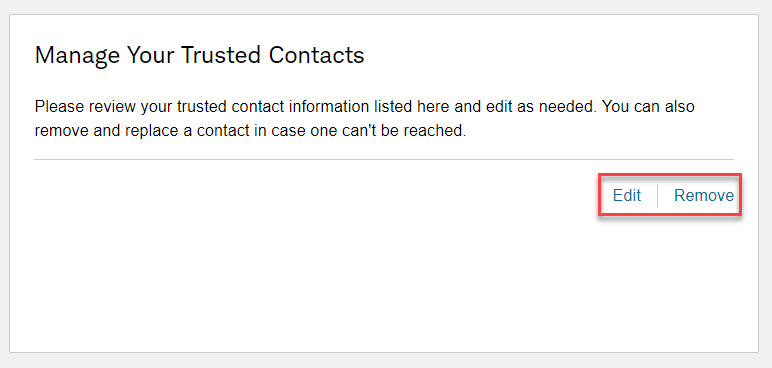

To EDIT or REMOVE: If you already have trusted contacts added, but need to make changes you can edit or remove.

The 5498 form reports IRA contributions (including catch-up contributions) and the fair market value of an IRA. If you made an IRA contribution, 60-day rollover, or direct rollover for the reporting year, you’ll get a 5498 form.*

We typically provide this form at the end of May. Eligible retirement account owners typically have until April 15 to make a prior-year contribution to their account. We will send the 5498 forms after that date to ensure all prior year contributions are included.

*Contributions to a qualified retirement plan (QRP) are reported on your W-2. The IRS and your tax professional can provide more information on reporting IRA contributions.

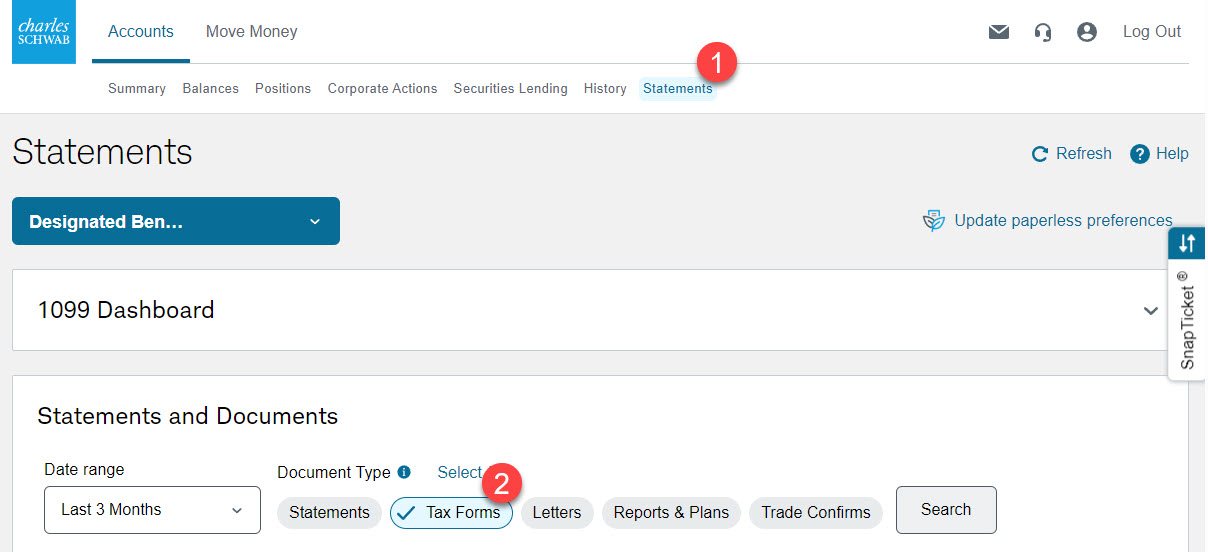

You can find the most recent versions of your consolidated 1099 and other tax documents in the Statements Section (1) within your Schwab Client portal. Simply click on the Tax Forms (2) section to find the form you need to download.

The IRS generally requires that you file an amended return on Form 1040X. You may also wish to seek the advice of a licensed tax advisor.

Schwab must issue a corrected 1099 when mutual funds and Real Estate Investment Trusts (REITs) reallocate or reclassify their distributions in January for the previous tax year. Occasionally this process isn’t complete, or Schwab has not yet received the updated information, by the time 1099s are due to be mailed.

IRS regulations require that we issue a corrected 1099 within 30 days of receiving information showing that the previously issued form was incorrect.

In this video, Schwab walks through the types of accounts that typically generate a 1099 and some of the most important sections of this tax document. Then they also talk about how the information on the form is used, when and how you’ll receive it, and the possibility of receiving a corrected 1099. Click Here.

Investment advisory services are offered through Trek Financial, LLC., an SEC Registered Investment Adviser. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. © Copyright 2021 Trek Financial. All Rights Reserved.