We are here to help you through the paperwork process. If at any point you need assistance please feel free to email our Service Center or contact your advisor directly.

A Schedule K-1 is usually generated if you hold investments in Limited Partnerships. These forms should always be submitted with your tax returns, so it is important to wait for the receipt of all Schedule K-1s before filing. Filing without your K-1s first will require the need to file an amended return. Unfortunately, funds will release K-1s at different times. However, K-1s are generally ready to view after March 17th.

Ways to access your K-1s:

It is important to note that your K-1s are tied to your social security number through this system so it will ask you to perform an identity verification process.

Since Tax Package Support is pulling sensitive information, we always recommend using a secure password manager such as Last Pass, to protect your passwords, instead of writing them down.

NOTE: The system connects your K-1s to your social security number so you will have to perform a identity verification process.

Open a new web browser and go to taxpackagesupport.com

![]()

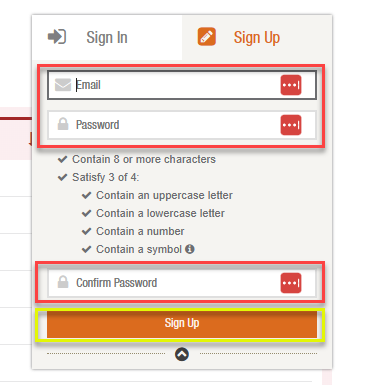

Click on “Sign Up” in the upper right-hand corner of the screen.

Add your email and create/confirm a password. Then click on “Sign Up.” Once this is done you will see a green box appear notifying you that a confirmation email has been sent to you.

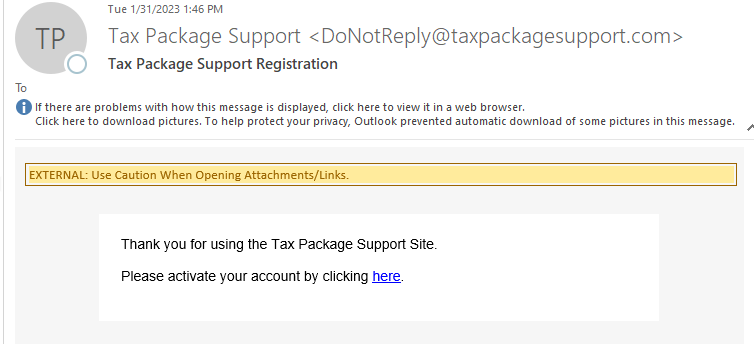

Go to your email inbox (or junk/clutter) to look for the confirmation email. It will come from donotreply@taxpackagesupport.com.

Click on the activation link. This link will redirect you to taxpackagesupport.com to continue the registration process.

Fill out the information in the form. NOTE that you will need to select the box that says “Notify me when K-1s are available” in order to receive notifications when they are ready for download.

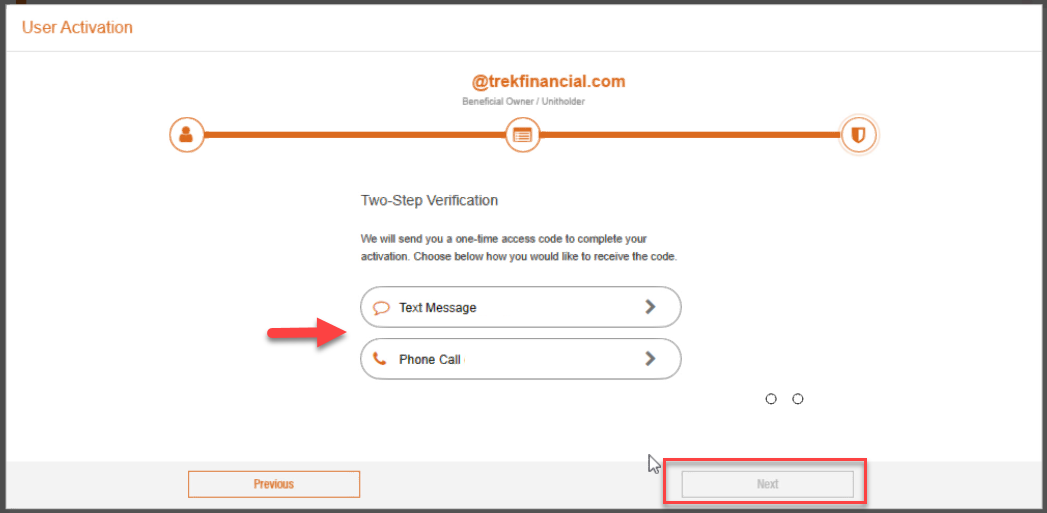

Verify with 2-step authentication. You can either choose to be sent a text (this will only work if the phone number you entered was a mobile phone number); or you can choose to receive a phone call. Both will provide you with a activation code which you will need to enter in the next step.

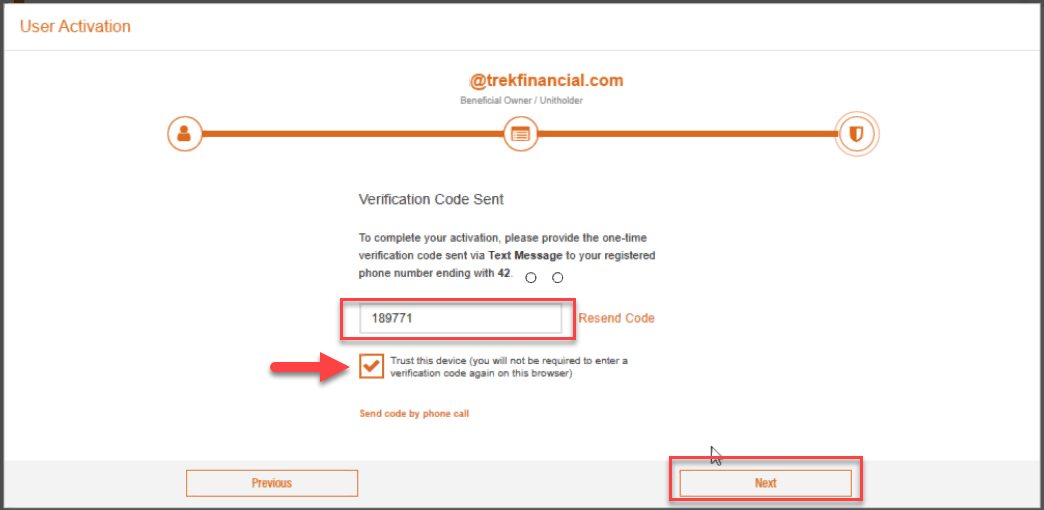

Enter the verification code you received. You can choose to select the box “Trust this device” however, we recommend only doing this if you are working from a personal device or computer, not a computer or device that can be accessed by the public.

NOTE that the activation code used in the image above is a sample and not a valid code.

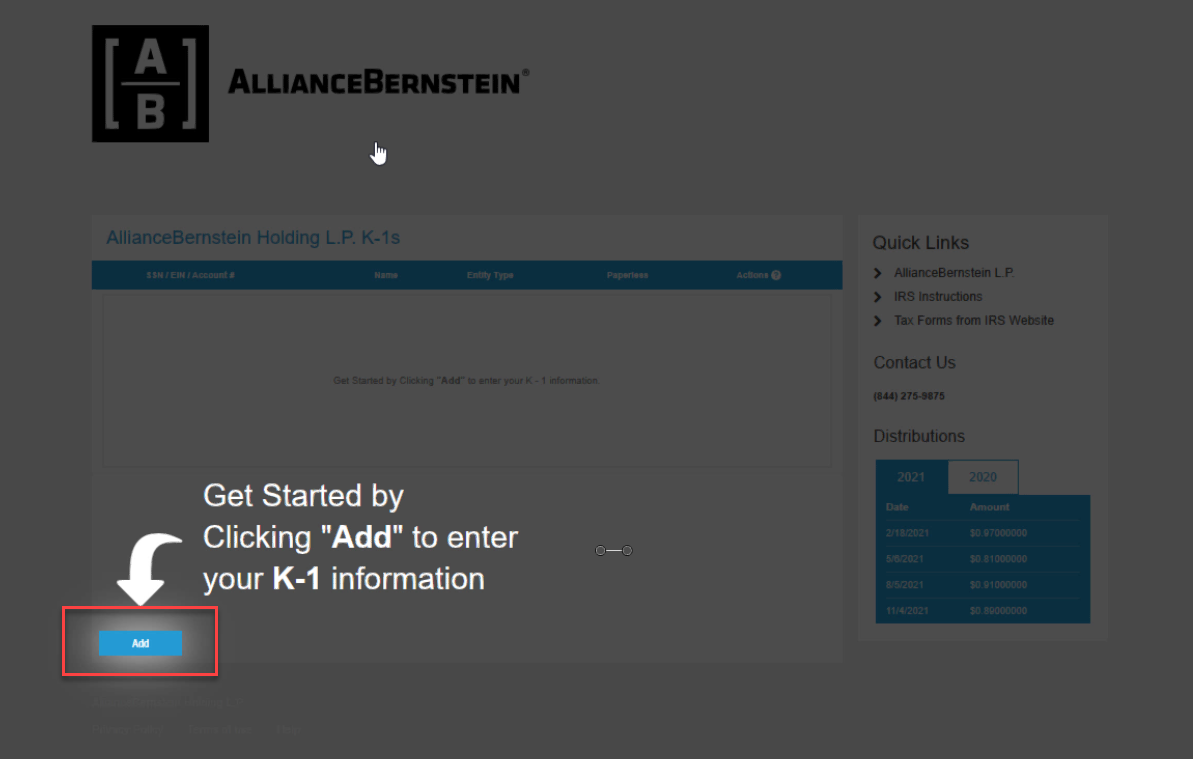

You will be redirected back to the home page where you can click on any fund to get started.

Once you are in the fund’s landing page, click on “Add” to start the identity verification process.

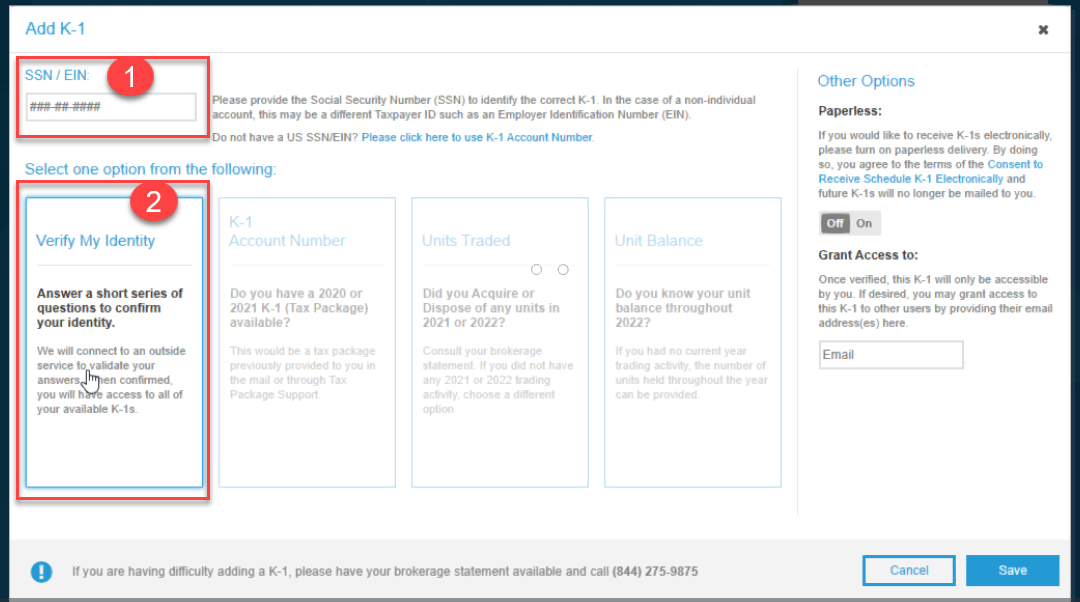

Within the popup that appears, enter your social and then click on “Verify My Identity”

Once you click on Verify Identity, you will be taken through a brief set of questions to confirm your identity. Once this is completed you are registered and set up to be notified and gain access to the K-1s that are generated for you. Once you receive a notification from Taxpackagesupport.com via email when your K-1 is ready, you can login to the system to view and download.

NOTE that K-1s are available at various times and you will receive a notification via email when yours are available.

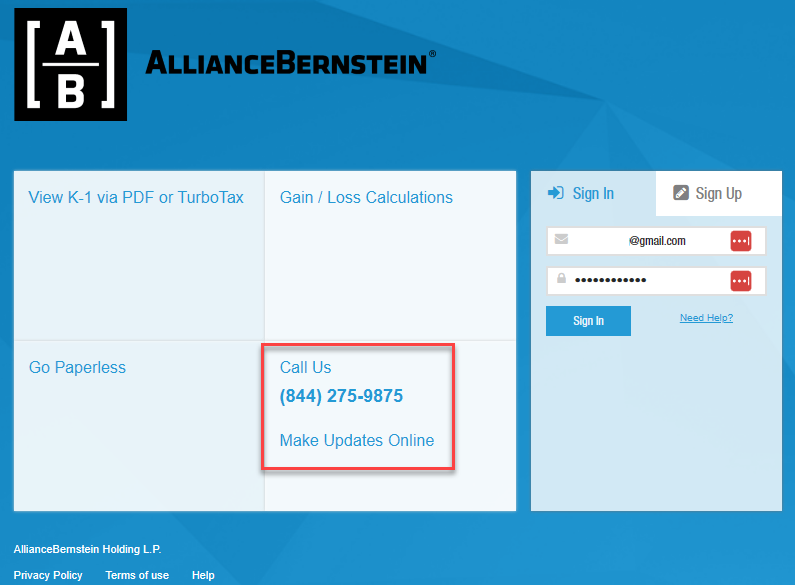

If you have questions, you can call any of the phone numbers located within any of the funds. (See example below)

Investment advisory services are offered through Trek Financial, LLC., an SEC Registered Investment Adviser. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. © Copyright 2021 Trek Financial. All Rights Reserved.